Venture Capital Meets VIP Rooms: Negotiation Tactics From Casino Hosts

The polished marble floors of high-end casinos and the glass-walled conference rooms of venture capital firms might seem worlds apart, but they share a crucial commonality: high-stakes negotiations where psychology trumps pure mathematics. Casino hosts, the masterful orchestrators of VIP experiences, have perfected negotiation techniques that venture capitalists are increasingly studying and adapting.

The Art of Invisible Leverage

At Danny Dollar Slot, casino hosts understand that their most powerful tool isn’t the comp suite or the private jet—it’s the ability to make clients feel simultaneously valued and subtly indebted. When a whale loses $2 million at the baccarat table, the host doesn’t immediately swoop in with consolation prizes. Instead, they might casually mention a exclusive restaurant reservation that “just became available” or arrange for the client’s favorite vintage wine to appear at dinner.

Venture capitalists have begun adopting this approach when courting entrepreneurs. Rather than leading with term sheets and valuations, savvy VCs create value through strategic introductions, industry insights, or access to their network. The negotiation begins long before anyone sits at a conference table, with the VC positioning themselves as an indispensable resource rather than just another funding source.

Reading the Room Through Micro-Signals

Professional casino hosts are trained to detect subtle behavioral cues that reveal a player’s psychological state. A slight hesitation before placing a bet, the way someone holds their chips, or changes in breathing patterns can indicate whether a player is feeling confident, desperate, or ready to walk away.

This hyper-awareness translates directly to VC negotiations. Experienced investors watch for entrepreneurs who speak faster when discussing certain business segments (potentially indicating uncertainty), teams where one founder consistently defers to another (revealing power dynamics), or startups that seem overly eager to close quickly (suggesting cash flow pressures or competing offers).

The key insight from casino hosts is that these micro-signals often matter more than the formal presentation. A host might extend a player’s credit line not because of their bank statements, but because their body language suggests they’re about to hit a winning streak. Similarly, VCs might increase their offer not based solely on financial projections, but because the founding team’s chemistry suggests exceptional execution potential.

The Strategic Use of Scarcity and Exclusivity

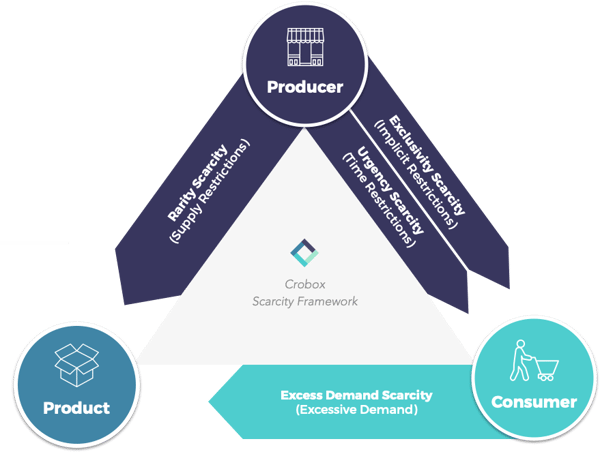

Casino hosts masterfully manufacture scarcity around experiences that could theoretically be replicated. The “last available” penthouse suite, the chef’s “special” tasting menu, or access to a “private” gaming room create artificial exclusivity that drives decision-making. The psychological principle is simple: we value what we believe others cannot easily obtain.

Top-tier VCs have weaponized this concept through carefully cultivated reputations for selectivity. When Sequoia Capital or Andreessen Horowitz expresses interest in a startup, the mere association becomes valuable currency. These firms deliberately maintain low acceptance rates and publicize their rejections of companies that later become successful, reinforcing the perception that their capital is inherently scarce.

The tactical application involves creating “decision windows” that feel natural but apply pressure. A casino host might mention that the private dining room has “one more opening this month,” while a VC might reference their “final partner meeting before summer” or suggest that their fund is “nearly fully deployed.” The scarcity feels legitimate because it’s grounded in operational reality, even when the timeline could be adjusted.

Emotional Temperature Control

Perhaps the most sophisticated skill casino hosts possess is emotional regulation—both their own and their clients’. During a losing streak, they maintain steady energy while subtly shifting the environment to improve their client’s psychological state. This might involve changing tables, adjusting lighting, or introducing new social dynamics through carefully selected companions.

Venture capital negotiations often involve similar emotional volatility. Entrepreneurs may feel euphoric about their company’s potential one moment and anxious about competition the next. Skilled VCs learn to maintain consistent demeanor while strategically influencing the emotional temperature of negotiations.

When discussions become tense around valuation or board control, experienced VCs might shift to discussing the entrepreneur’s long-term vision, introduce success stories from their portfolio, or even suggest taking a break to visit one of their successful companies. Like casino hosts, they understand that decisions made in optimal emotional states tend to be more favorable to their interests.

The Long Game Perspective

Casino hosts think in terms of lifetime value, not individual sessions. A player who loses modestly but consistently over months is often more valuable than someone who wins big once and disappears. This perspective shapes every interaction, with hosts investing in relationships that may not pay off for years.

The best VCs adopt this same temporal framework. They recognize that today’s entrepreneur might become tomorrow’s successful founder who remembers which investors supported them early. Even when passing on an investment, they maintain relationships and provide value, understanding that the startup ecosystem is remarkably interconnected.

This long-term thinking also influences deal structure. Rather than maximizing ownership percentage in a single round, sophisticated VCs focus on maintaining relationships that enable them to participate in future rounds, support portfolio companies through introductions, and build reputations that attract higher-quality deal flow.

Information Asymmetry as Competitive Advantage

Casino hosts possess detailed psychological profiles of their clients—spending patterns, emotional triggers, relationship dynamics, and decision-making tendencies. This information asymmetry provides enormous negotiating advantages, as hosts can anticipate reactions and structure offers accordingly.

VCs increasingly employ similar information-gathering strategies. Through their networks, they often know about a startup’s customer traction, team dynamics, and competitive positioning before the first meeting. They understand which investors a company has already spoken with, what terms have been discussed, and sometimes even internal disagreements about strategic direction.

The ethical application of this advantage involves using information to create better outcomes for both parties, rather than exploitative manipulation. A casino host might use their knowledge to suggest games where a player is more likely to succeed, while a VC might structure deals that address specific concerns they know the founding team harbors.

Conclusion: The Psychology Behind the Numbers

Both casino hosts and venture capitalists operate in environments where technical expertise must be combined with sophisticated psychological understanding. The most successful practitioners in both fields recognize that deals are ultimately made between humans, with all the emotional complexity that entails.

The convergence of these approaches reflects a broader recognition that negotiation is as much art as science. While financial models and market analysis provide the foundation, the ability to read people, manage emotions, and build genuine relationships often determines outcomes in high-stakes situations.

As the venture capital industry becomes increasingly competitive, those who master these human-centered negotiation tactics—borrowed from the casino floor’s most skilled operators—may find themselves with significant advantages in the battle for the best deals and strongest founder relationships.