The High-Stakes Gamble: What Slot Volatility Can Teach You About Business Risk

Understanding Volatility: The Foundation of Strategic Decision-Making

In the intricate landscape of modern business management, understanding risk assessment parallels the mathematical principles found in slot machine volatility, such as those demonstrated in the Hacksaw Le Cowboy slot. We recognize that both domains require sophisticated analysis of probability, variance, and expected outcomes. The concept of volatility—whether in gaming mechanisms or corporate strategy—provides invaluable insights into how organizations can navigate uncertainty while maximizing potential returns.

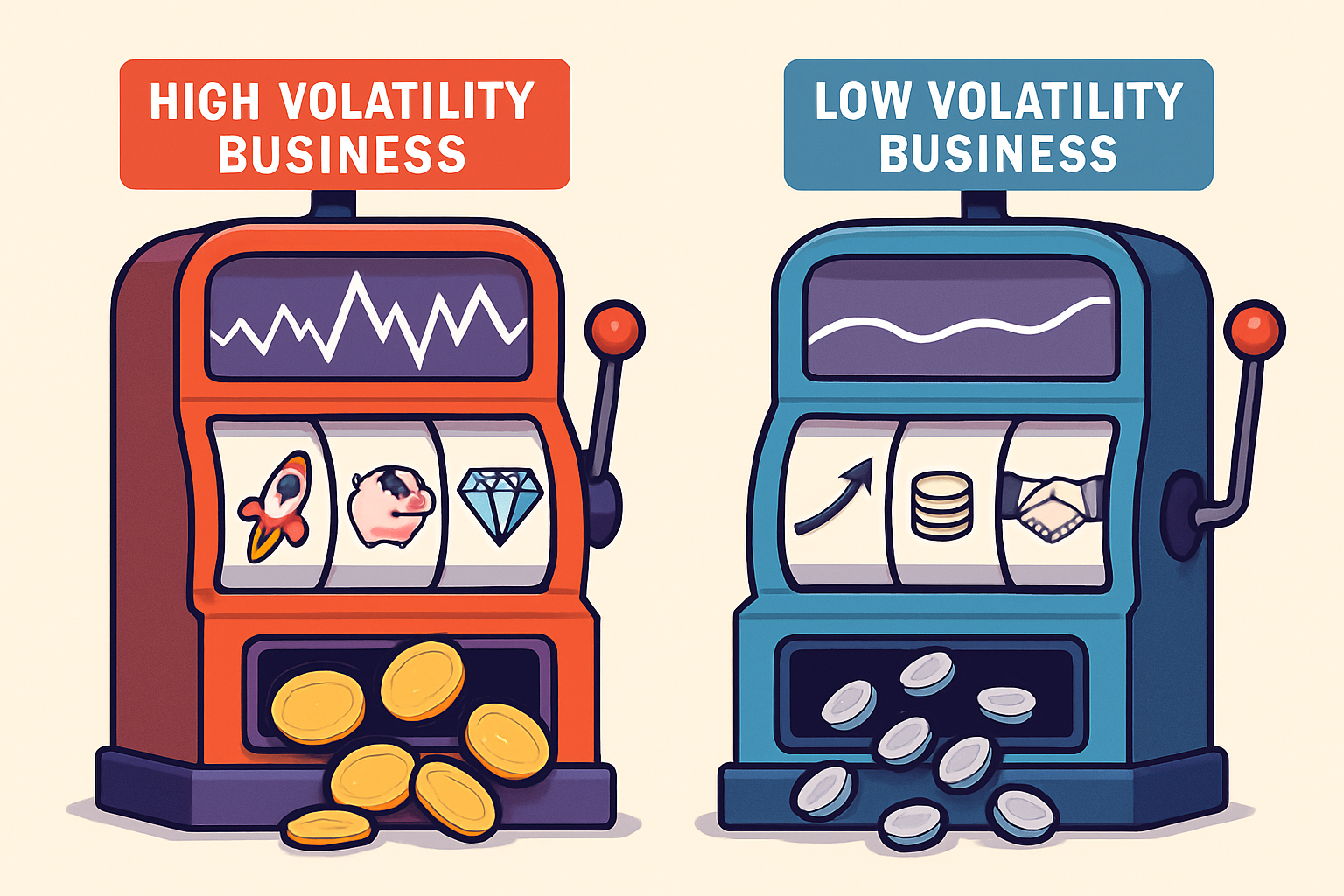

Slot volatility, often referred to as variance, measures the frequency and magnitude of payouts in gaming systems. Low volatility machines deliver smaller, more frequent wins, while high volatility options offer larger payouts with extended intervals between successes. This fundamental principle mirrors the risk-reward continuum that business leaders face daily when allocating resources, entering markets, or launching innovative products.

The Mathematics of Risk: Translating Gaming Theory to Business Strategy

We observe striking parallels between slot machine algorithms and business forecasting models. Both systems operate on principles of expected value calculation, where outcomes are determined by multiplying probabilities with their associated rewards. In slot games, the Return to Player (RTP) percentage represents the theoretical long-term payout, typically ranging from 92% to 98%. Similarly, businesses calculate expected returns on investment (ROI) by analyzing historical data, market conditions, and competitive landscapes.

The volatility index in gaming directly correlates to what we term business risk profiles in corporate environments. Organizations pursuing aggressive growth strategies resemble high-volatility slots—they accept extended periods of resource consumption and negative cash flow in pursuit of transformative market breakthroughs. Conversely, companies focusing on steady dividend payments and incremental growth mirror low-volatility machines, prioritizing consistency over explosive expansion.

High-Volatility Approaches: When to Bet Big

High-volatility business strategies demand substantial capital reserves, extended timelines, and unwavering stakeholder commitment. We identify several scenarios where this approach proves most effective:

Innovation-driven industries require high-volatility investments. Pharmaceutical companies exemplify this model, investing billions in research and development with the understanding that most drug candidates fail during clinical trials. However, a single successful medication can generate returns exceeding initial investments by orders of magnitude. This mirrors the high-variance slot experience where players endure numerous losing spins awaiting a jackpot trigger.

Disruptive market entry represents another high-volatility scenario. When organizations challenge established competitors with fundamentally different value propositions, they accept significant upfront losses while building market share and brand recognition. Technology startups frequently embrace this model, prioritizing user acquisition and platform development over immediate profitability.

We emphasize that high-volatility strategies require specific organizational characteristics: deep financial reserves, patient capital sources, leadership capable of maintaining strategic focus during extended performance troughs, and cultures that view temporary setbacks as data points rather than failures. Without these elements, high-volatility approaches can exhaust resources before potential rewards materialize.

Low-Volatility Frameworks: Building Sustainable Value

Low-volatility business models prioritize predictable cash flows, stable market positions, and incremental improvements. We recognize that these approaches, while less glamorous than their high-risk counterparts, form the backbone of economic stability and long-term wealth creation.

Franchise operations exemplify low-volatility business architecture. By replicating proven systems across multiple locations, franchise organizations minimize experimental risk while generating consistent revenues. Each unit produces moderate returns, but the aggregate effect creates substantial enterprise value with manageable downside exposure.

Subscription-based revenue models represent another low-volatility framework. Software-as-a-Service companies, streaming platforms, and membership organizations benefit from predictable recurring income that facilitates accurate forecasting and efficient resource allocation. This mirrors the frequent small-win pattern of low-volatility slots, where players experience regular positive reinforcement that sustains engagement.

We observe that low-volatility strategies excel in mature markets with established customer behaviors, regulatory environments that favor incumbents, and competitive landscapes where brand reputation and operational efficiency create defensible advantages. Organizations in sectors such as utilities, consumer staples, and essential services naturally gravitate toward these models.

The Bankroll Principle: Capital Allocation and Risk Management

Experienced slot players understand the bankroll management principle—the critical relationship between available funds, bet sizing, and volatility selection. We apply this identical framework to corporate capital allocation decisions.

Adequate capitalization relative to chosen risk profiles determines organizational survival probability. Companies pursuing high-volatility strategies without corresponding financial reserves face catastrophic failure risk, similar to players attempting high-variance slots with insufficient bankrolls. The mathematics proves unforgiving: even strategies with positive expected value produce ruin when variance exceeds available capital.

We recommend that organizations conduct rigorous scenario analysis that accounts for volatility in their strategic planning. This involves stress-testing business models against adverse conditions, calculating minimum viable runway periods, and establishing clear metrics that trigger strategic pivots. Just as disciplined slot players set loss limits before beginning sessions, effective business leaders define acceptable risk exposure thresholds before launching initiatives.

Diversification serves as the primary volatility mitigation tool in both domains. Slot enthusiasts distribute bankrolls across multiple machines and sessions to reduce variance impact. Similarly, corporations build portfolios of initiatives spanning the volatility spectrum—combining stable cash-generating operations with higher-risk innovation projects. This balanced approach captures upside potential while maintaining organizational stability.

Reading the Paytable: Understanding Your Risk-Reward Structure

Every slot machine displays a paytable outlining winning combinations and their associated payouts, much like the detailed mechanics you can explore in a game such as https://lecowboyslot.com/. We advocate for similar transparency in business risk assessment through comprehensive risk-reward mapping.

Organizations must clearly articulate expected outcomes across the probability distribution—not merely best-case scenarios but realistic assessments of modal outcomes, downside possibilities, and tail risks. This paytable thinking prevents the cognitive biases that lead to systematic underestimation of failure probabilities and overestimation of success magnitudes.

We implement decision trees that quantify branch probabilities and outcome values at each strategic juncture. This methodology transforms abstract risk discussions into concrete mathematical frameworks that facilitate rational capital allocation. Just as slot paytables make variance transparent, decision trees illuminate the actual risk-reward structure of business opportunities.

Calibration exercises improve organizational forecasting accuracy over time. By systematically comparing predicted outcomes against actual results, we refine probability estimates and reduce systematic biases. This learning loop mirrors how experienced players develop intuitive understanding of slot volatility through repeated observations.

Timing and Persistence: When to Continue and When to Walk Away

The gambler’s fallacy—believing that previous outcomes influence independent future events—represents a cognitive trap affecting both casino players and business leaders. We emphasize that each slot spin constitutes an independent trial with fixed probabilities, just as most business outcomes depend primarily on fundamental factors rather than previous results.

However, strategic persistence differs fundamentally from fallacious thinking. When pursuing high-volatility initiatives with positive expected value, temporary setbacks provide information but shouldn’t necessarily trigger abandonment. We distinguish between strategies failing due to flawed premises versus those experiencing normal variance around sound fundamentals.

Kill criteria establish objective conditions warranting strategic termination. Rather than allowing sunk cost fallacy to perpetuate failing initiatives, we define measurable thresholds that, when breached, mandate reassessment or discontinuation. This discipline prevents the catastrophic capital depletion that occurs when organizations “chase losses” by escalating commitment to failing strategies.

Conversely, we recognize that premature termination of high-volatility strategies represents an equally costly error. Organizations must distinguish between natural variance in legitimate strategies versus fundamental flaws requiring correction. This judgment demands sophisticated analysis and experienced leadership capable of reading subtle signals in noisy data.

The House Edge Reality: Accounting for Systemic Headwinds

Slot machines incorporate a house edge—the mathematical advantage ensuring casino profitability over sufficient iterations. We identify analogous systemic costs in business environments that organizations must overcome to generate genuine value.

Market friction—including transaction costs, regulatory compliance expenses, competitive pressures, and organizational inefficiencies—functions as the business equivalent of house edge. These factors create a performance threshold that strategies must exceed to produce positive returns. Failing to account for these persistent drags leads to strategies that appear viable in idealized models but prove unworkable in practice.

We conduct comprehensive total cost analysis that captures all relevant friction sources. This includes obvious expenses but also opportunity costs, organizational bandwidth consumption, and strategic distraction effects. Only after quantifying these factors can organizations accurately assess whether initiatives clear the performance hurdle necessary for value creation.

Competitive dynamics intensify this challenge. In markets where numerous participants pursue similar strategies, competition compresses margins and raises execution standards. This mirrors how slot players collectively face negative expected value despite individual win potential. Organizations must honestly assess whether they possess differentiated capabilities justifying confidence in above-market returns.

Practical Applications: Implementing Volatility-Informed Strategy

We translate these theoretical insights into actionable frameworks through several implementation mechanisms:

Portfolio construction treats the corporate strategy as a collection of initiatives with varying volatility profiles. We explicitly classify projects along the risk spectrum and ensure appropriate balance. This prevents the common failure mode where organizations inadvertently concentrate excessive capital in either overly conservative or dangerously aggressive positions.

Metrics systems must capture volatility alongside expected value. Traditional performance measurement often emphasizes means while ignoring variance, creating incentive structures that inadvertently encourage excessive or insufficient risk-taking. We implement reporting frameworks that make volatility transparent and manageable.

Organizational design should align with strategic volatility profiles. Teams pursuing high-variance initiatives require different structures, talent profiles, and governance mechanisms than those managing low-volatility operations. We resist the temptation to impose uniform processes across fundamentally different risk contexts.

Stakeholder communication benefits from volatility framing. By explaining that strategic choices involve deliberate variance selection rather than uncertain competence, leadership can maintain stakeholder confidence during the inevitable drawdowns accompanying high-volatility approaches. This transparency prevents the panic that leads to counterproductive mid-course corrections.

Conclusion: Mastering the Volatility Framework

The principles governing slot machine volatility provide powerful metaphors and mathematical frameworks for understanding business risk. By recognizing that variance constitutes an independent strategic dimension alongside expected value, we make more sophisticated resource allocation decisions.

Organizations that master volatility-informed strategy gain competitive advantages through superior capital efficiency, more accurate forecasting, and better alignment between capabilities and chosen risk profiles. This discipline transforms risk from an abstract concern into a manageable strategic variable.

We emphasize that neither high nor low volatility approaches are inherently superior—context determines appropriateness. The critical insight involves consciously selecting volatility levels aligned with organizational resources, competitive positions, and stakeholder expectations while maintaining rigorous analytical discipline throughout execution.

The high-stakes gamble of business leadership becomes more manageable when viewed through the lens of volatility theory. By applying the mathematical rigor developed in gaming contexts to corporate strategy, we navigate uncertainty with greater confidence and achieve superior long-term results.